Venture Capital Investments in Pakistani Startups

Investments in Pakistani HQ Startups – H1’ 2021 Highlights

- In H1’2021 , US$ 78 M were reportedly invested in 25 startups headquartered in Pakistan, by 89 VCs from 15 countries. Majority of the investors were from the USA.

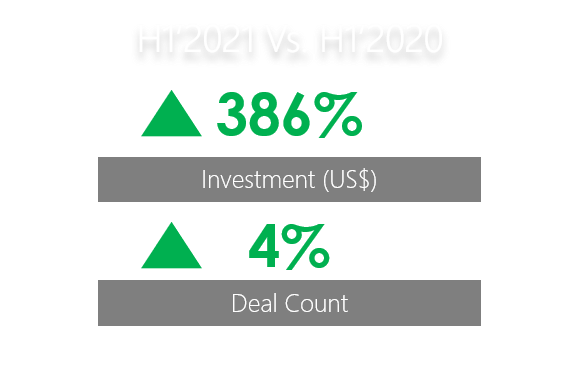

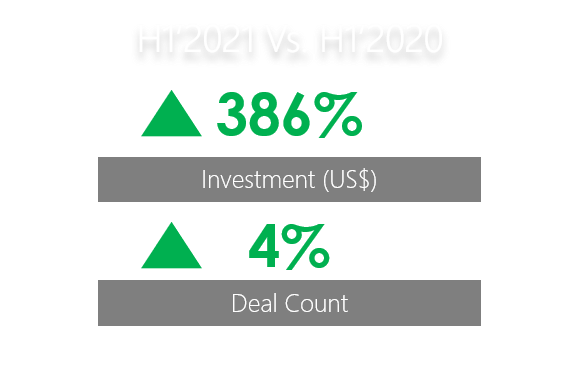

- Compared to H1’2020, in H1’2021, VC funding in Pakistani HQ startups increased by 386% while the number of deals increased by 4%.

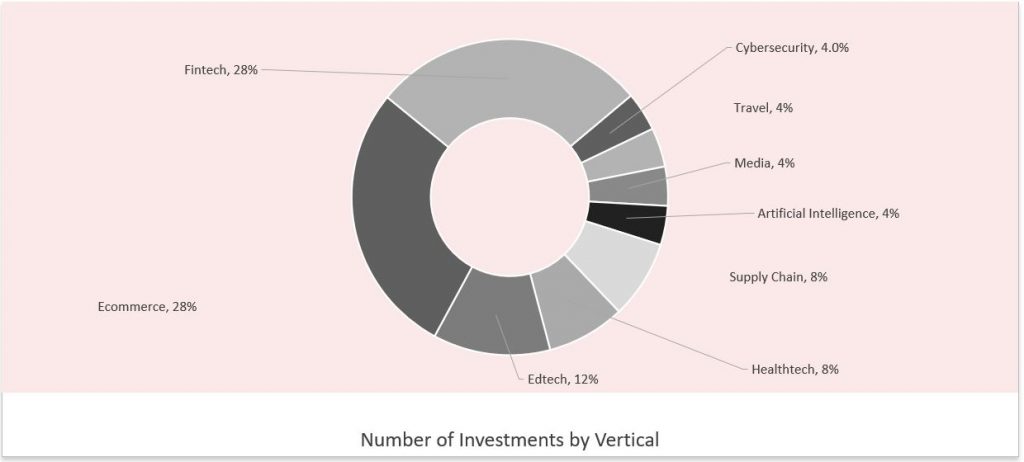

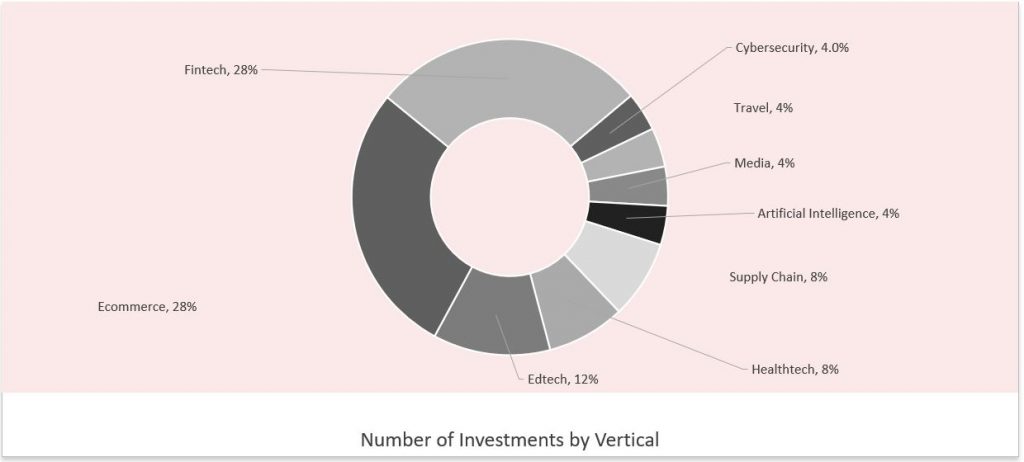

- Majority of the investments were in E-commerce, Fintech and Edtech startups in Lahore, Karachi and Islamabad.

- At least 18 VCs made more than one investment in Pakistani HQ startups in H1’2021, with Fatima Gobi Ventures, i2i ventures and Global Founders Capital leading the pack.

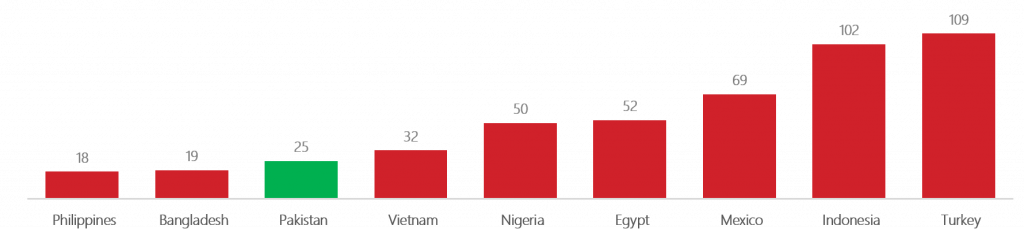

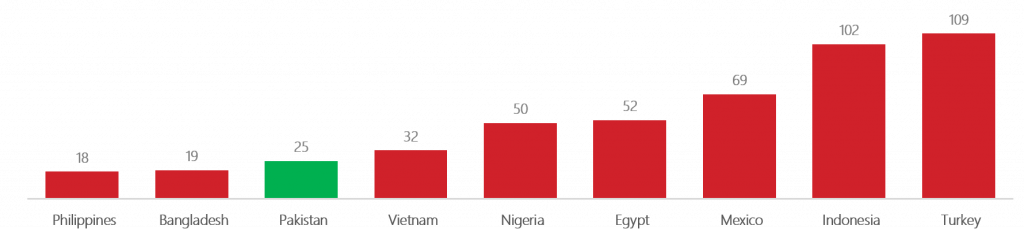

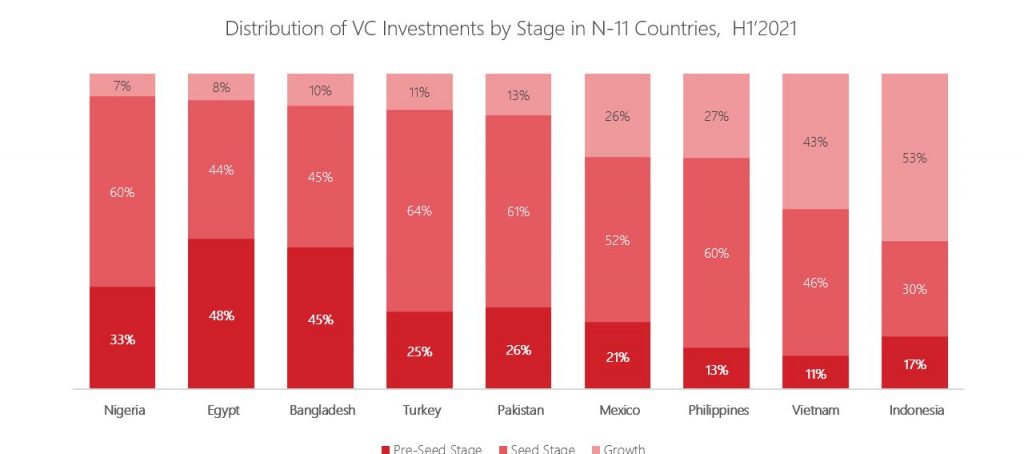

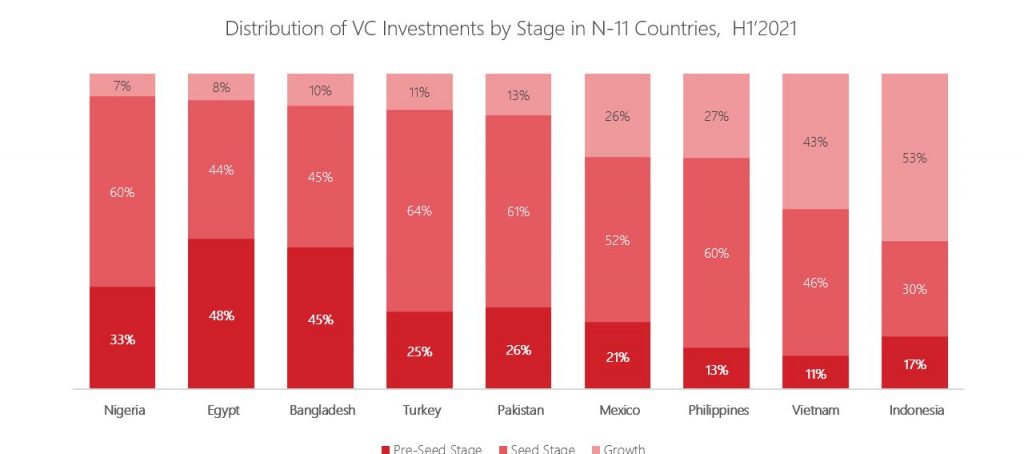

- Among similar N-111countries, Pakistan remained a frontier market in H1’2021, with relatively lower investment activity and higher investor focus on early stage deals.

1) N-11 (Next 11) countries is a group of countries identified by Goldman Sachs with the potential to become the world’s large economies in the 21st century. We have excluded S.Korea and Iran from our analysis.

Sources : www.crunchbase.com , Mashkraft research and analysis. Analysis excludes startups with HQs outside of Pakistan, investments in funds and debt financing.

H1’2021 Snapshot: Investments in startups with HQs in Pakistan

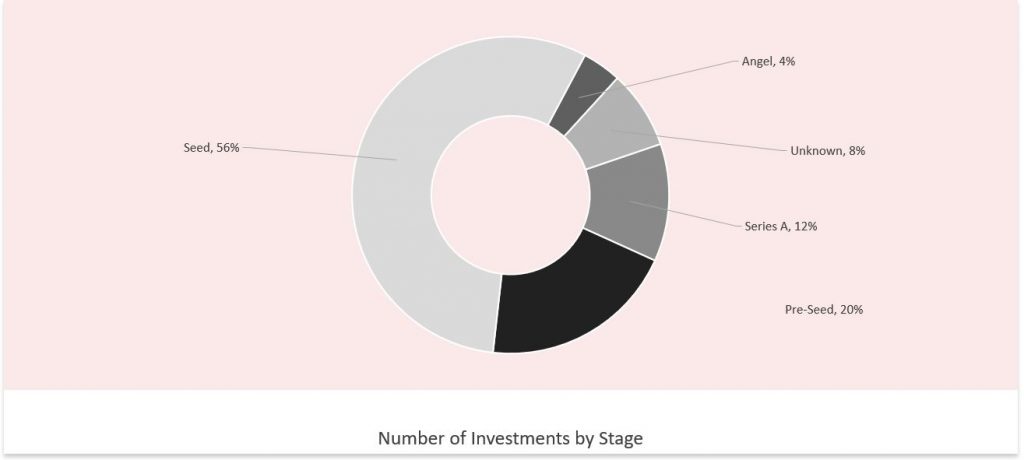

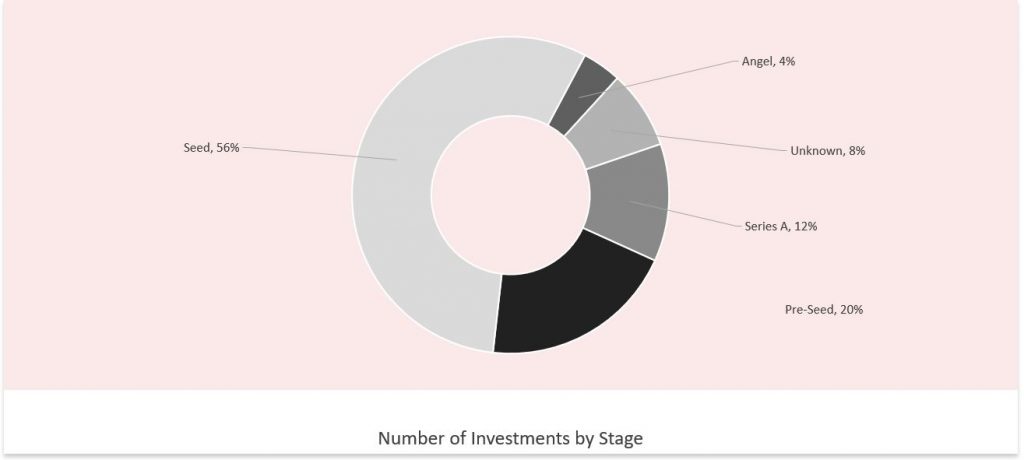

Investors were primarily focused on early stage fintech & ecommerce startups

Investment Trends : VC funding and deals in Pakistani HQ startups

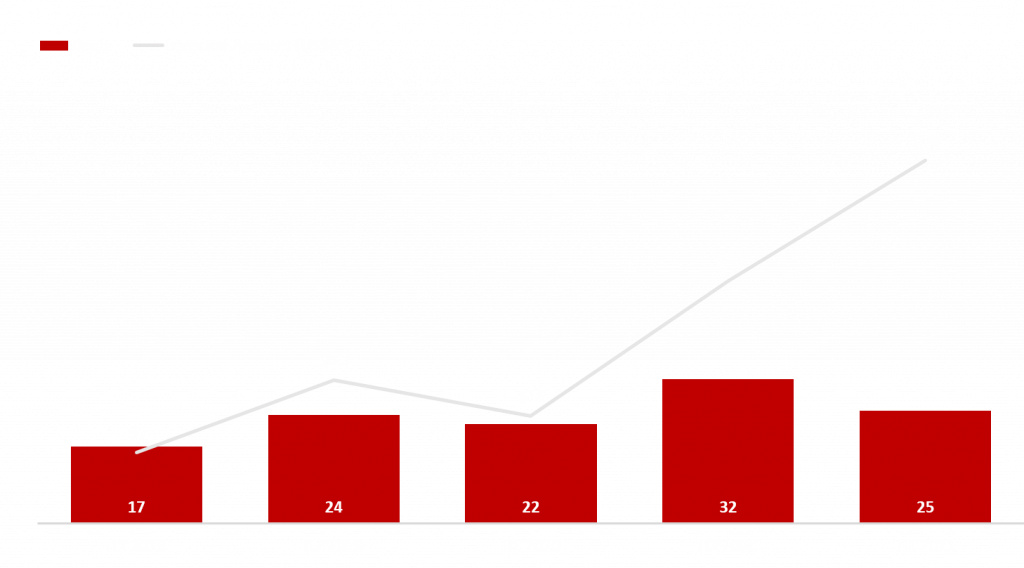

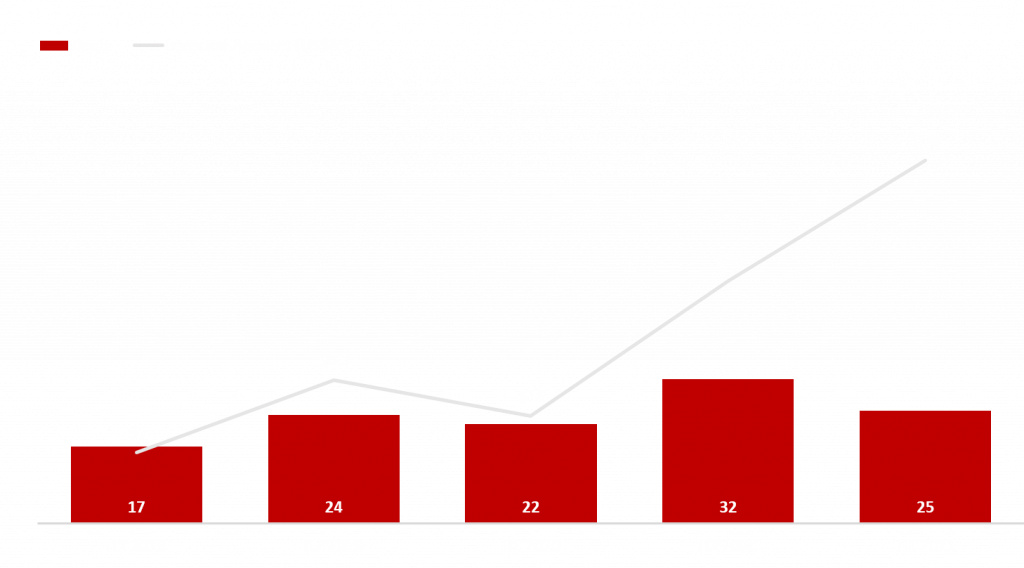

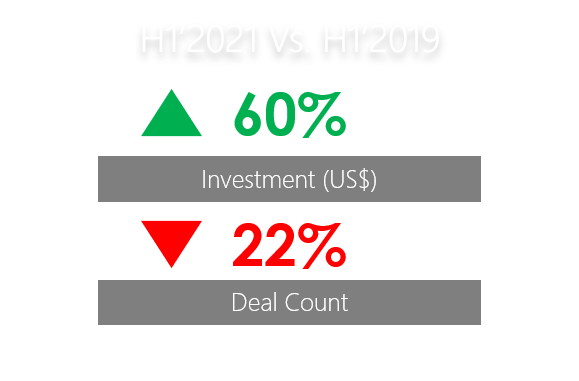

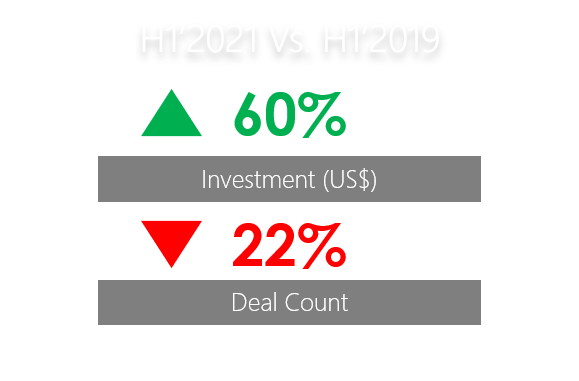

Investments have grown significantly since H1’2019, but with high volatility

VC Backed Deals and Financing in Pakistani Startups, H1’2019 – H1’2021

Which Pakistani HQ startups raised most funding in H1’2021 ?

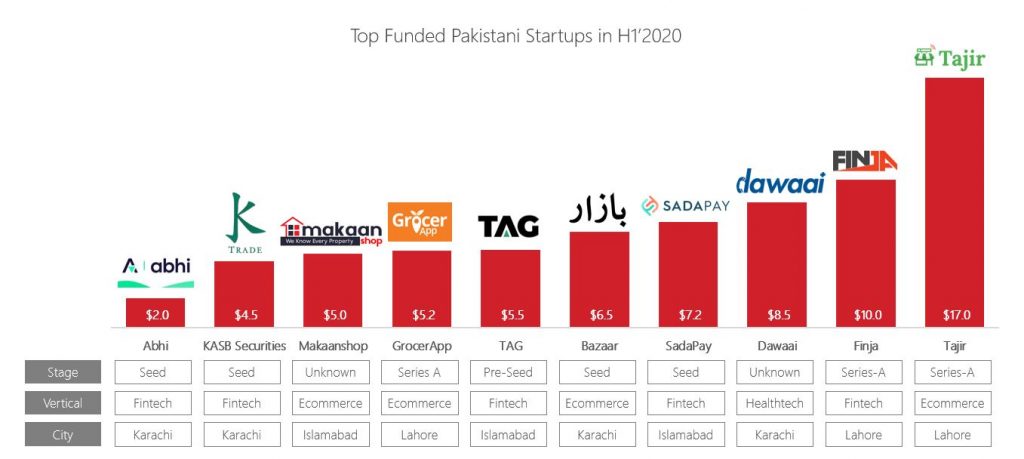

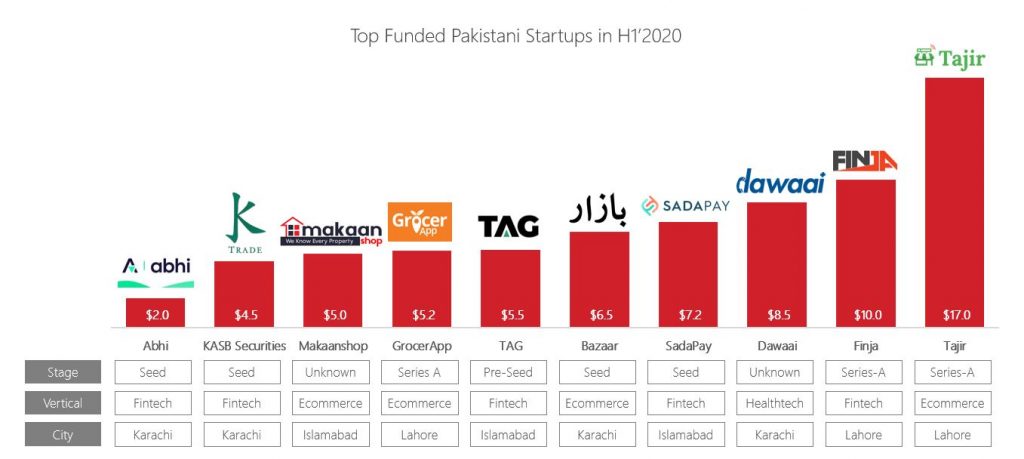

Tajir raised most VC funding at US$17M, while the top 10 deals jointly raised US$60 M

Who were the top investors in Pakistani HQ startups in H1' 2021 ?

18 out of the 89 VCs active in Pakistan in H1’2021 invested in more than one startup

4

Investments

Fatima Gobi Ventures

3

Investments

I2I ventures

3

Investments

Global Founders Capital

2

Investments

10K Ventures

2

Investments

Zayn Capital

2

Investments

Mentors Fund

2

Investments

Venture Souq

2

Investments

VEF

2

Investments

SOSV

2

Investments

Quiet Capital

2

Investments

Kingsway Capital

2

Investments

MOX

2

Investments

Liberty City Ventures

2

Investments

Indus Valley Capital

2

Investments

HOF Capital

2

Investments

BitRate Venture Capital

2

Investments

Sarmayacar

2

Investments

Walled City Co.

Startup investments in H1’2021: Pakistan vs. select N-111 countries

Investments and deals in Pakistan were lower compared to other N-11 countries

Number of VC Deals by N-11 Country, H1’2021

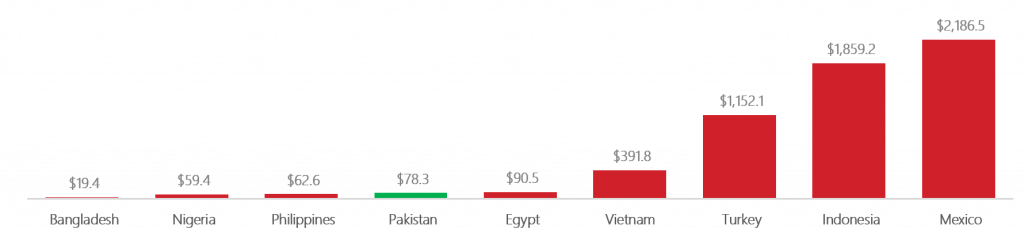

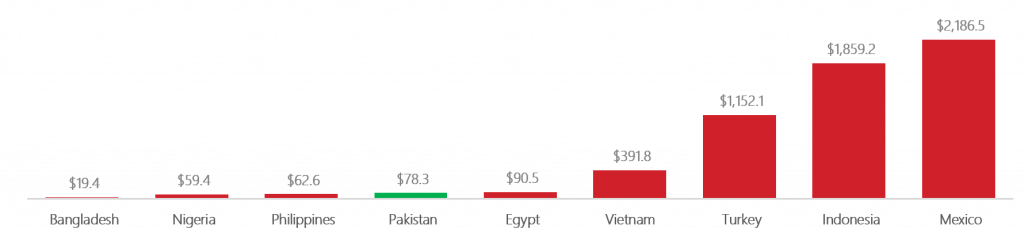

Total Reported VC Funding (US$M) by Country – H1’2021

1) N-11 (Next 11) countries is a group of countries identified by Goldman Sachs with the potential to become the world’s large economies in the 21st century. We have excluded S.Korea and Iran.

Sources : www.crunchbase.com , Mashkraft research and analysis. Analysis excludes startups with HQs outside of Pakistan, investments in funds and debt financing.

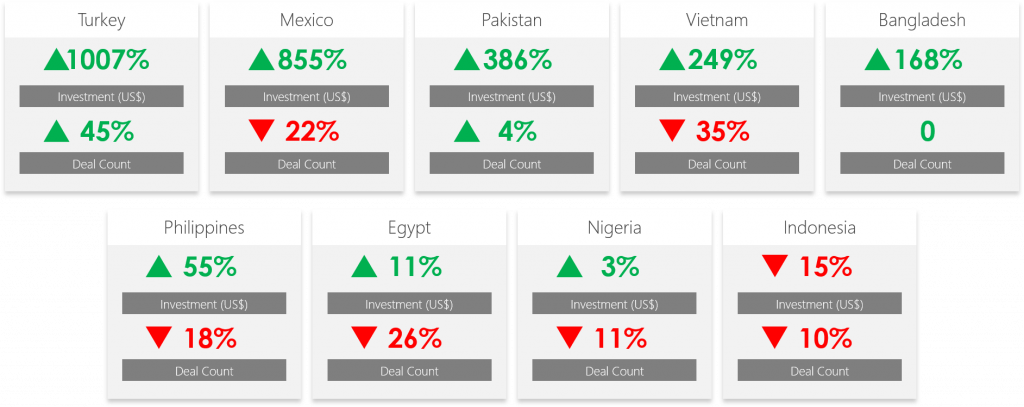

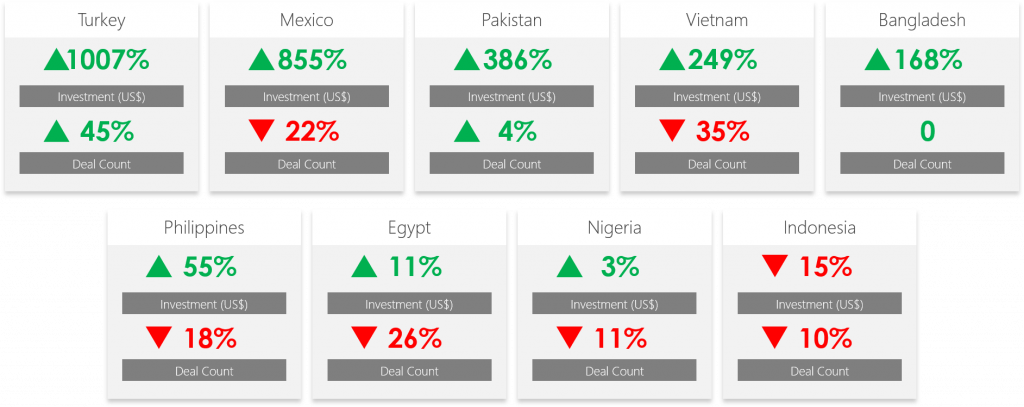

H1’2021 vs. H1’2020 startup investments : Pakistan vs. N-111 countries

Growth in funding and investments in Pakistan was relatively high among N-11 countries

VC investments in startups in N-11 countries – H1’2021 vs H1’2020

1) N-11 (Next 11 )countries is a group of countries identified by Goldman Sachs with the potential to become the world’s large economies in the 21st century. We have excluded S.Korea and Iran.

Sources : www.crunchbase.com , Mashkraft research and analysis. Analysis excludes startups with HQs outside of Pakistan, investments in funds and debt financing.

Startup ecosystem maturity in H1’ 2021 : Pakistan vs. N-111 countries

Like in most N-111 countries, VCs’ focus in Pakistan remained on early stage deals

1) N-11 (Next 11) countries is a group of countries identified by Goldman Sachs with the potential to become the world’s large economies in the 21st century. We have excluded S.Korea and Iran.

Sources : www.crunchbase.com , Mashkraft research and analysis. Analysis excludes startups with HQs outside of Pakistan, investments in funds and debt financing.

Pakistani Startup Funding League Tables : 2016 - 2021

Top Funded Ventures in Pakistan, Excluding Exits, between 2016 – 2021

US$89M

Carfirst

US$24M

Airlift

US$22M

Zameen

US$20M

Finja

US$19M

Tajir

Most Active VCs in Pakistan between 2016 and 2021

10

Investments

Sarmayacar

8

Investments

Walled City Co

7

Investments

Karavan

7

Investments

Indus Valley

7

Investments

Fatima Gobi

Sources : www.crunchbase.com , Mashkraft research and analysis. Analysis excludes startups with HQs outside of Pakistan, investments in funds and debt financing.