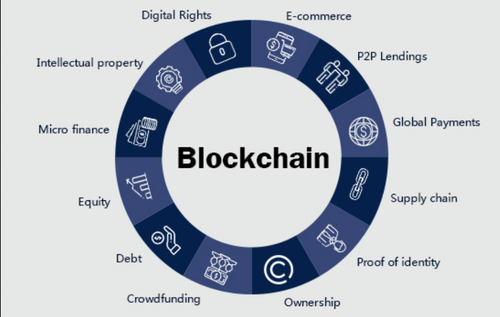

Blockchain services have been around for some time now. Initially, the Blockchain services were used in Cryptocurrency specifically for Bitcoin. After seeing the security and safety features of blockchain services, the technology has slowly spread. It is implemented in the financial sector, healthcare, and supply chain management. In blockchain cryptocurrency, the financial ledger was decentralized from a single control group and all users had control over it. After the success in blockchain cryptocurrency in 2009, many businesses are looking to use this database for their business purposes. In the past few years, Blockchain companies have been set up after an increase in demand for these types of databases. These blockchain companies provide blockchain solutions for all businesses. A blockchain company can focus on one type of blockchain solution or provide complete blockchain solutions.

Market Size of Blockchain

Blockchain is a fast-developing technology. It has been growing rapidly since the late 2000s. It is demanded by small-scale businesses and enterprises alike. According to the ‘Reports and Data’ survey of 2019, “the Blockchain Market Size is expected to reach USD 60.12 Billion by 2026.” Another recent report from November 2021 by Market and Markets forecasts the market size to be at USD 67.4 Billion by 2026. As can be seen, the forecast market size sees a rapid increase in two years. This indicates that by 2026, this market size could reach over USD 70 billion.

Impact of Blockchain in Finance Sector

With blockchain, the connectivity and programmability increased manifold. Some of the impacts of blockchain are discussed.

Authentic Information: Data integrity enables asset and transaction history in a single shared source. These sources are saved in ledgers and encrypted.

Programmability: Code can be directly added to the system. These can include governance, compliance, data privacy, and the identity attribute codes. Other codes can include system incentives and features that manage stakeholder participation (for voting and other rights).

Streamlined system: Operational efficiency is increased by automation. Blockchain enables real-time settlement and audit reporting. The processing times are reduced. The potential for error and delay is reduced. The transaction is direct between the customer and the bank.

Economic benefits: Blockchain automation reduces the costs of infrastructure. The cost of operation is reduced due to cloud technology.

Security Features: Digitization security features are customizable. These can be made according to the demands of the customer.

These are some of the impacts that blockchain technology is providing to the financial sector.

Understanding Blockchain in Supply Chain

Blockchain records data and stores it in blocks that are joined or linked in a chain. Blockchain in the supply chains is those blockchain supply chains that use the blockchain database in the process of producing and distributing a certain product or service between the company and its clients. The best blockchain development company in any part of the world are those blockchain service providers who can offer the best business solution for the blockchain supply chain of each product.

Blockchain in Finance Sector

Blockchain in finance is gaining popularity. There is no hiding the fact that the financial sector has faced challenges. With a plethora of Fintech solutions available in the market, blockchain solutions are an overall solution.

Secure and Transparent

Blockchain’s main components are its security and transparency which makes it a popular solution in the financial crisis. The financial sector has been centralized for decades which is causing problems in current times. The centralized data goes through a lot of middlemen and offices which makes it vulnerable to getting hacked or stolen at any stage. A blockchain database is encrypted with two security keys which means that once a transaction goes through the data is encrypted and saved in the block. It cannot be altered or changed without the agreement of all parties involved and needs the security keys for access. In finance, the data can be verified without disclosing it.

Cost-Effective

The use of blockchain databases reduces running costs. Usually, the financial companies invest heavily in purchasing central databases, security of these databases, maintenance, and other tools. Even with such heavy investment, the data in these get compromised by getting hacked. A blockchain system significantly reduces costs. According to “The Fintech 2.0 Paper: Rebooting financial services” Blockchain databases reduce the cost of financial services infrastructure up to USD 15 Billion – USD 20 Billion per annum by 2022.

Instant Settlement

Financial transactions, without blockchain databases, could take days to get settled. They would go through several people before getting finalized. With blockchain databases, the financial transactions are instantly settled and the data stored and encrypted for storage purposes. Apart from this, the financial transactions between foreign companies and clients instantly take place and get verified quickly.

Transparent Auditing

The auditing process is long and daunting with the companies unethically hiding data from the auditors. Companies using blockchain databases can streamline their audits and cut down on the time. Immutable blockchain data can help auditors check on compliance as the information provided would be complete and transparent.

Offshoring for Finance Blockchain

With the rise of newer financial technology, traditional methods and offshoring need to change. Government policies for greater transparency are making the financial sector rethink policies.

Offshore is still the best option for the financial sector. Offshoring helps in providing the new concept of open banking. This means that the consumers’ every bank account will be connected under one application.

Secondly, offshoring helps in cross-country payments. These are more secure than before. This helps online commerce businesses reach more audiences. They can set up brick and mortar locations. Setting up offshore accounts helps in streamlining accounts. Accounts are accessible anywhere in the world. Furthermore, blockchain helps a bank set up branches in other countries.

As blockchain is providing security, chances of fraud are reduced. As blockchain is a decentralized ledger it provides an advantage. The ledgers are many and secure. The ledger saves data in blocks. Transaction information is encrypted using cryptography. The information stored cannot be accessed without both party’s permission.

FinTech’s use of blockchain is revolutionary which is why it is being implemented in banks all over the world quickly.

Mashkraft for Blockchain Management

At Mashkraft, our experts will provide clients with solutions for blockchain management in FinTech. We have a diverse portfolio of supplying our clients with successful blockchain solutions. Our offshore team will be on-hand according to needs and budget. We have worked with clients in Africa, North America, Asia, and Europe. You can contact our team and read up more about our business solutions for FinTech at www.mashkraft.com

The Bottom Line

Blockchain services in finance keep the transactions secure and risk-free from hacks. Blockchain in supply chain data storage of transactions keeps records secure and ensures transparency. Records can be obtained and used in case of any legal issues, which is why blockchain services are highly demanded. Now, blockchain is even entering the healthcare sector due to its security features. So, we can look forward to seeing blockchain used in several sectors in the coming years.