Q1-2022 : State of Venture Capital Investments in the Next-11 Countries

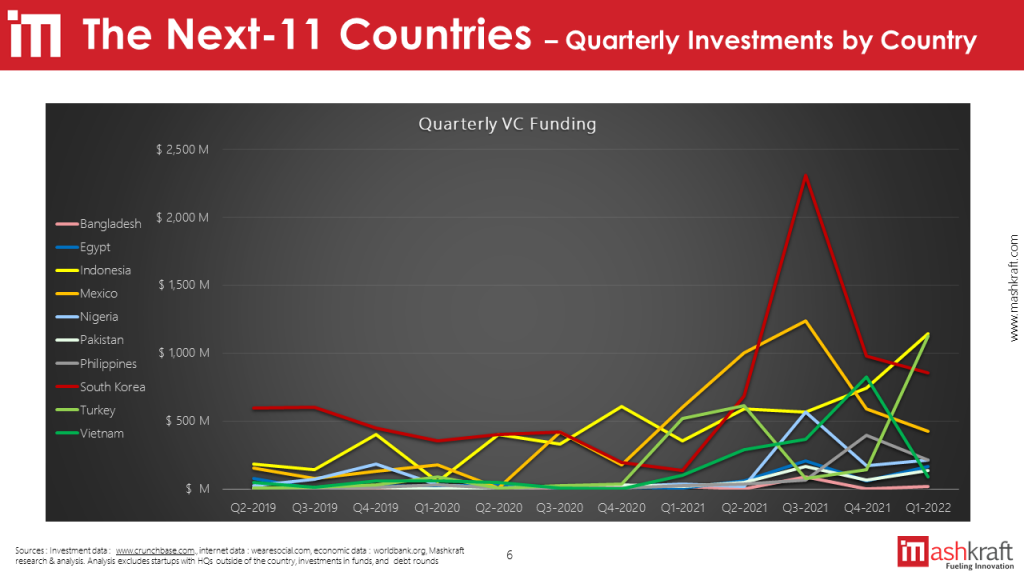

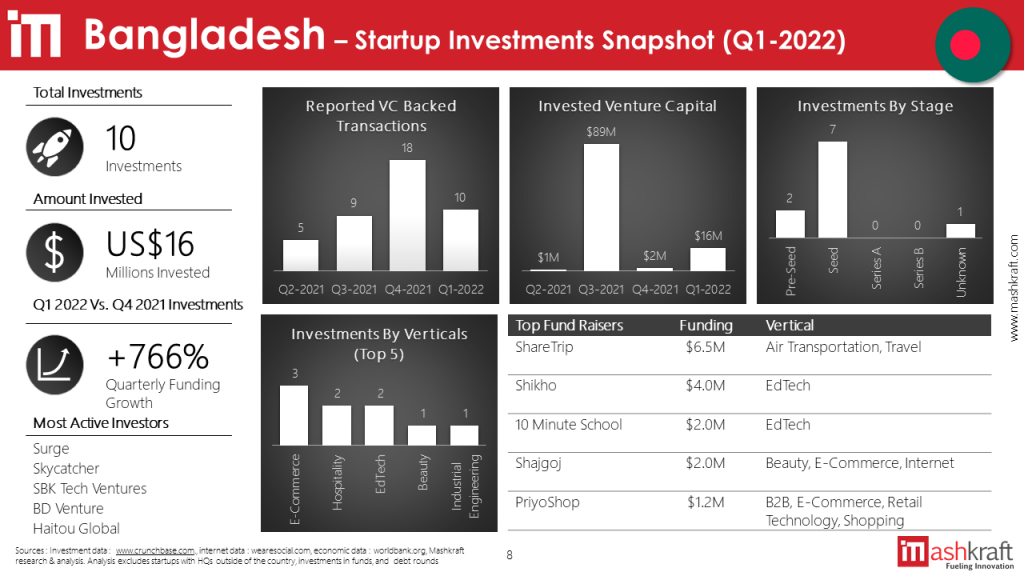

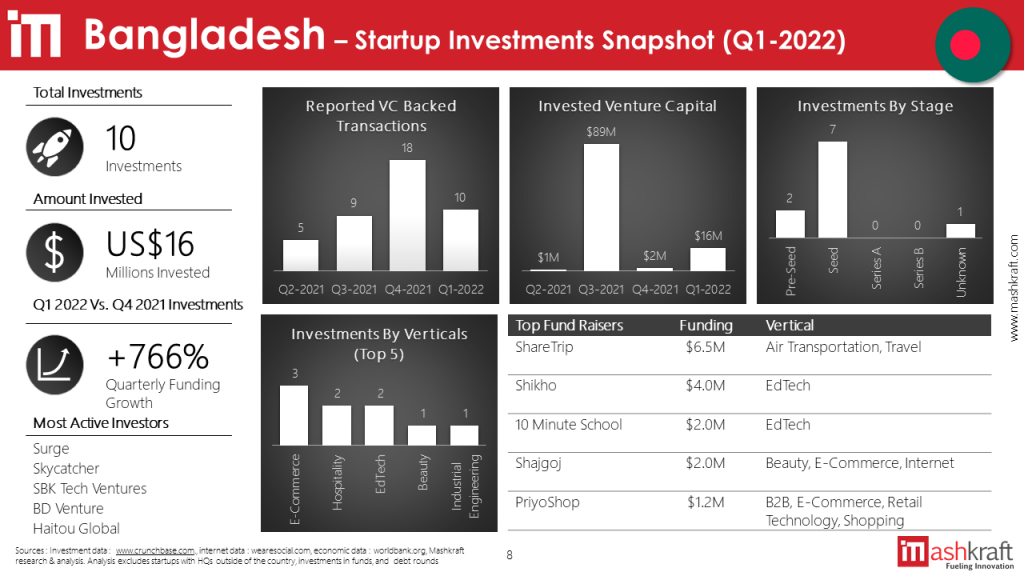

Bangladesh

Bangladeshi startups saw at least 10 VC funding rounds in Q1-2022 with US$16M in invested capital, a 9x increase compared to Q4-2021. Most of the investments went into e-commerce and edtech companies. Sharetrip, a Dhaka-based end-to-end travel solutions platform attracted the most funding with $6.5 M in a Seed round from US-based Skycatcher.

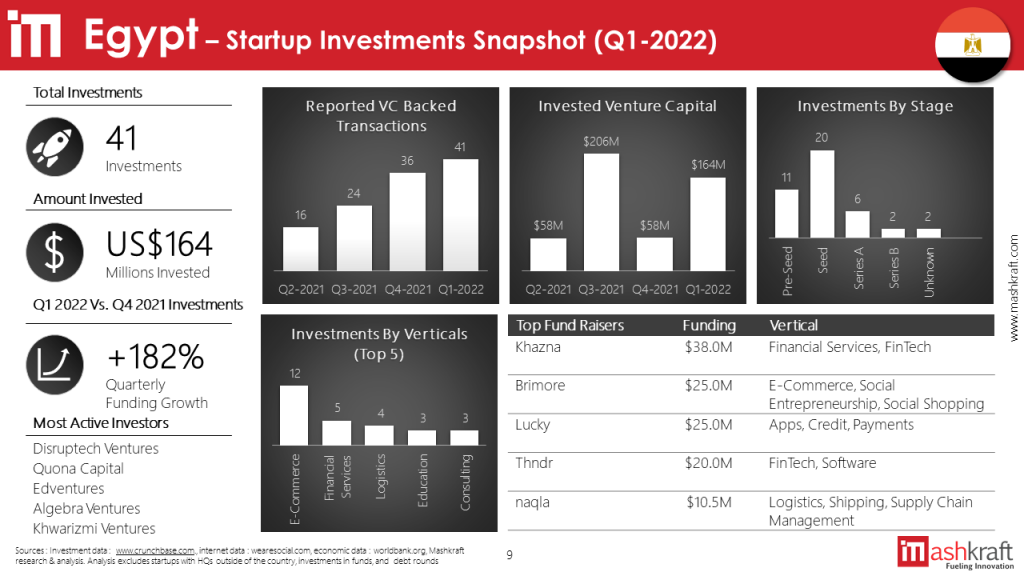

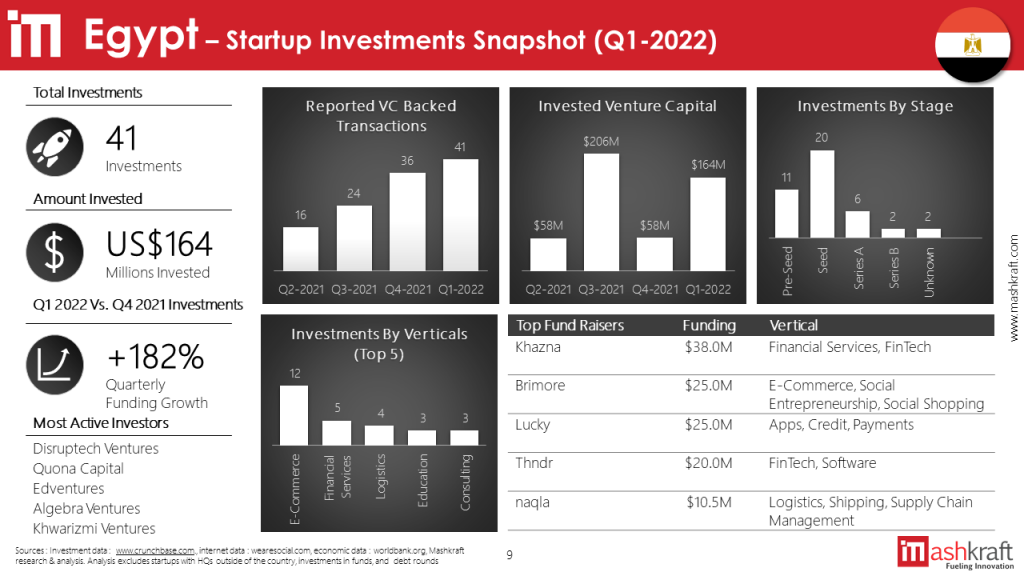

Egypt

Egyptian startups saw at least 41 VC funding rounds in Q1-2022 with US$164M in invested capital, a 3x increase compared to Q4-2021. Most of the investments went into FinTech and e-commerce companies. Khazna, a Cairo-based financial services platform for labourers, contractors and small businesses attracted the most funding with US$38 M in a Series A round led by US-based Quona Capital.

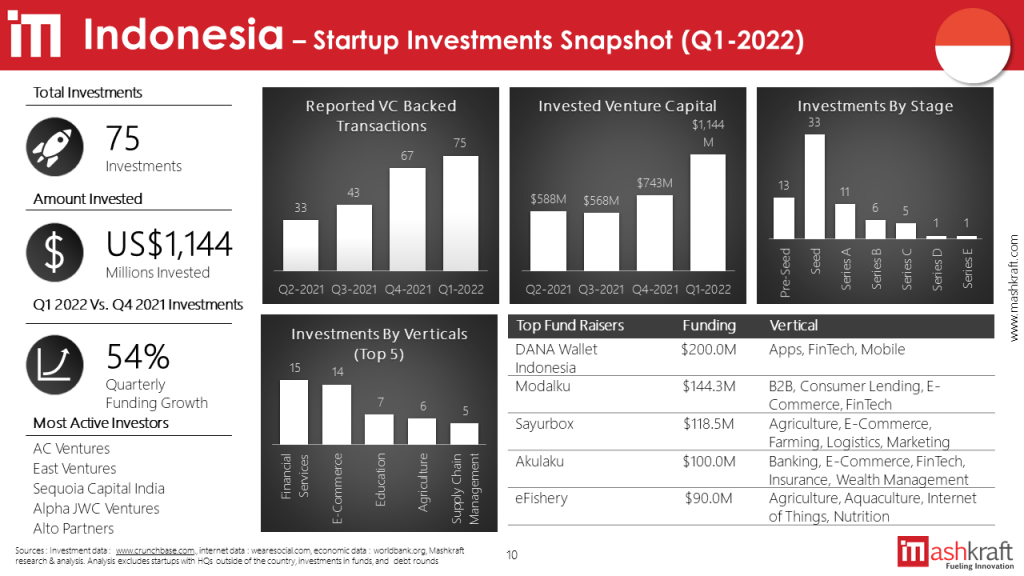

Indonesia

Indonesian startups saw at least 75 VC funding rounds in Q1-2022 with US$1.1 B in invested capital, a 1.5x increase compared to Q4-2021. Most of the investments went into FinTech and AgTech companies. DANA Wallet, a Jakarta-based digital wallet platform attracted the most funding with US$200 M invested by the Indonesian conglomerate, the Sinar Mas Group.

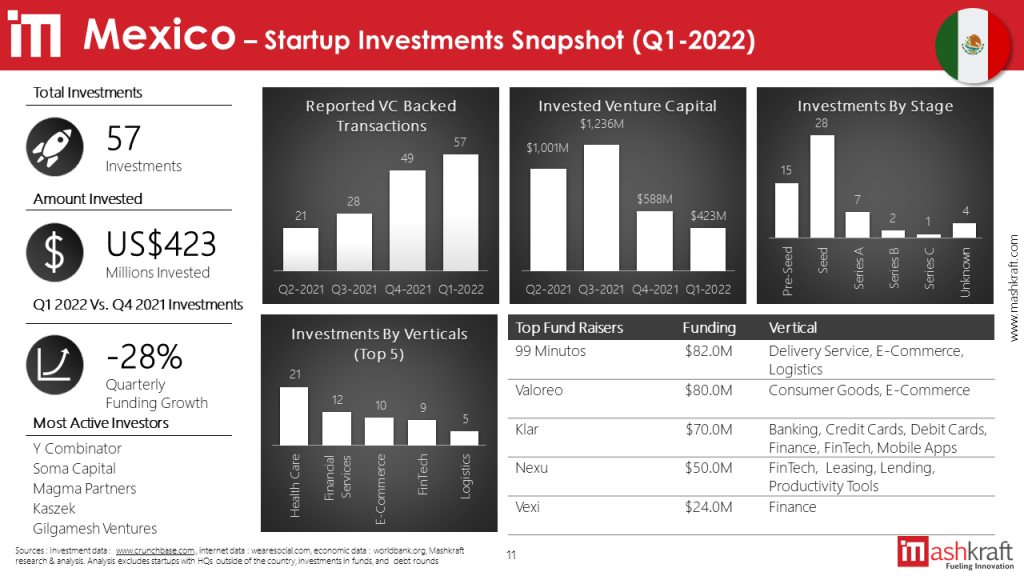

Mexico

Mexican startups saw at least 57 VC funding rounds in Q1-2022 with US$423M in invested capital, a 28% decrease compared to Q4-2021. Most of the investments went into FinTech and e-commerce companies. 99 Minutos, a Mexico City-based e-commerce delivery platform that operates across Latin America, attracted the most funding with US$82 M in a Series C round led by US-based OAK HC/FT Capital.

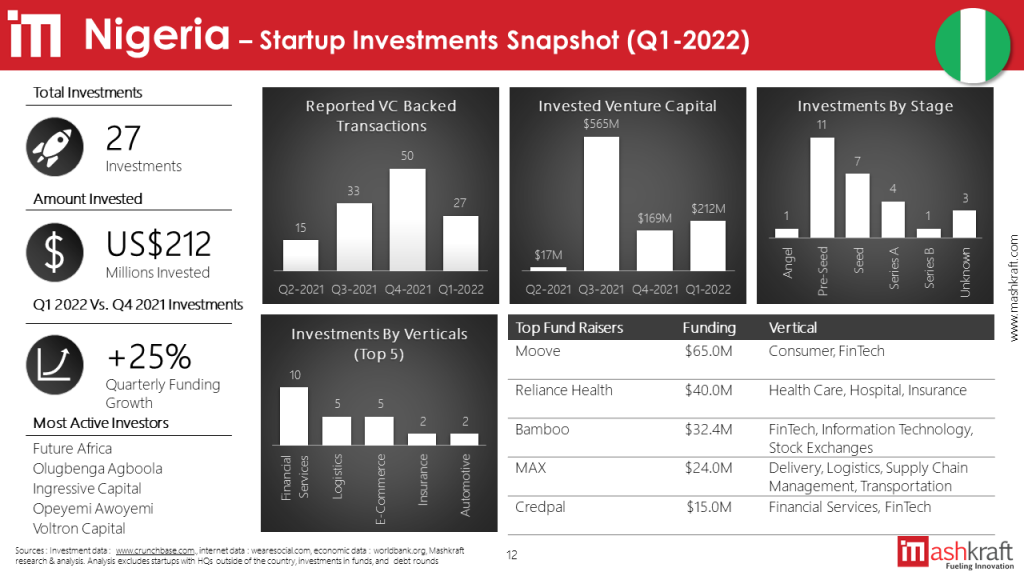

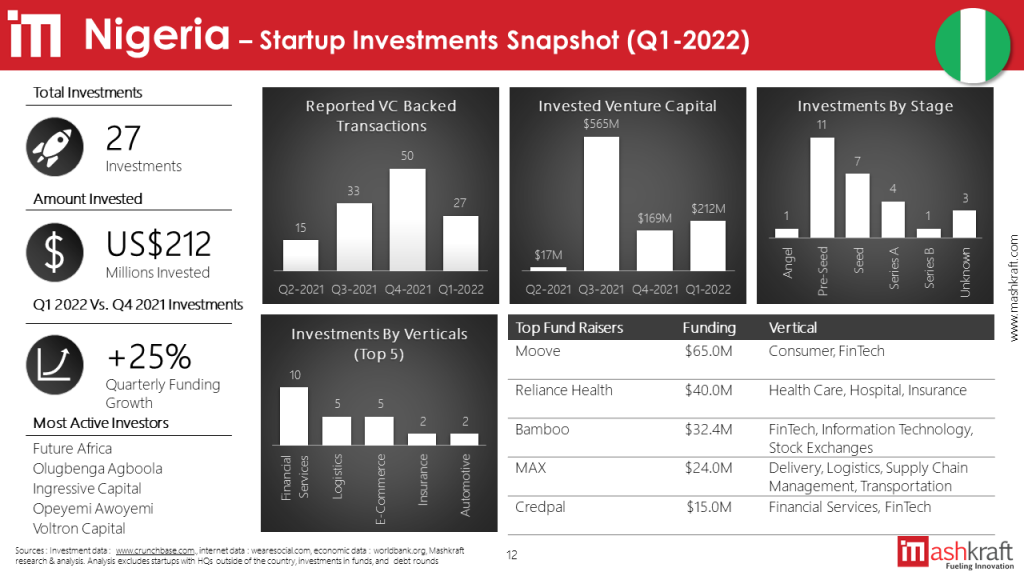

Nigeria

Nigerian startups saw at least 27 VC funding rounds in Q1-2022 with US$212M in invested capital, a 25% increase compared to Q4-2021. Most of the investments went into FinTech companies. Moove, a Lagos-based startup that provides revenue-based vehicle financing (for example to uber drivers) , attracted the most funding with US$65 M in a Series A round led by US-based Left Lane Capital and Austria based Speedinvest.

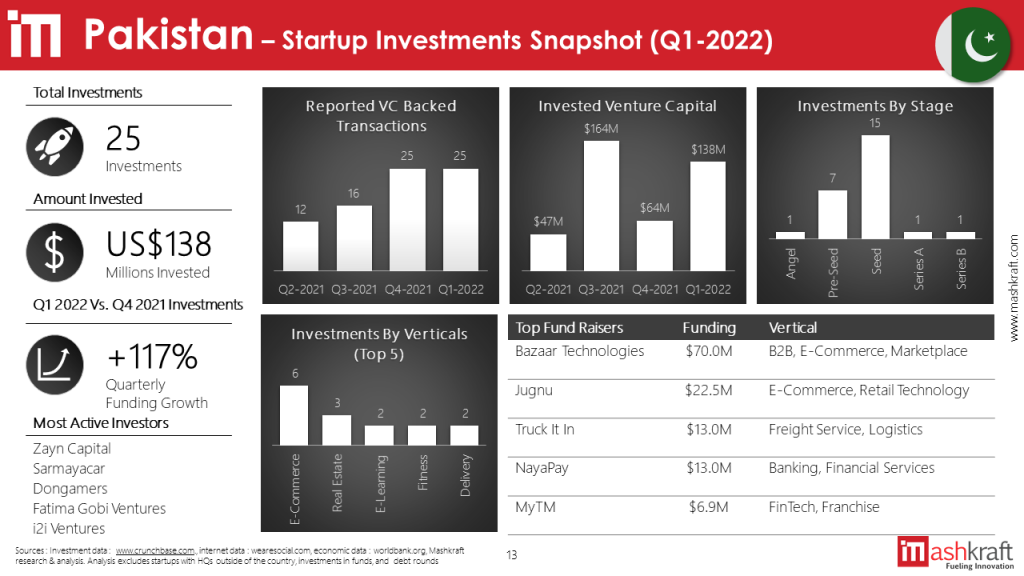

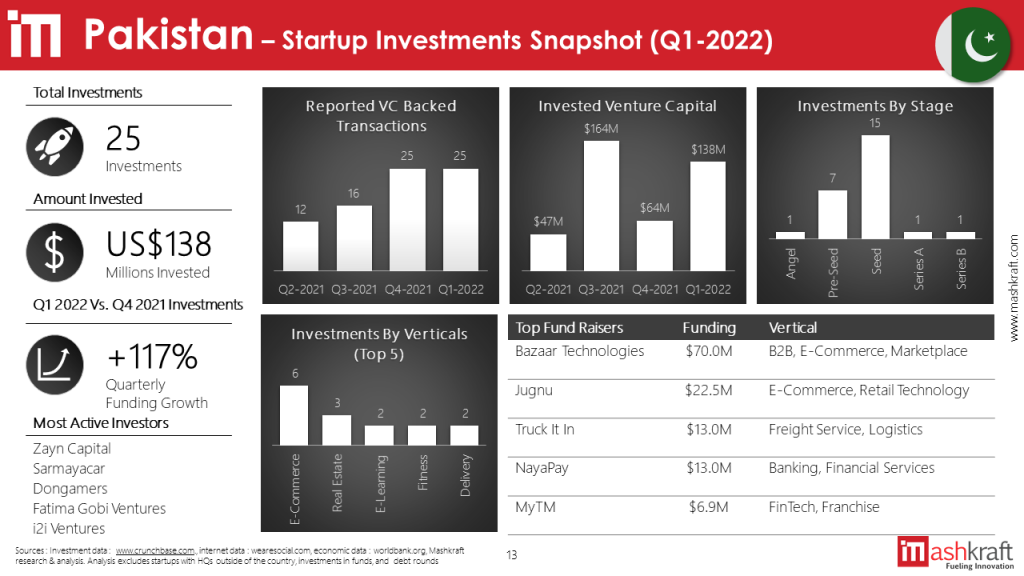

Pakistan

Pakistani startups saw at least 25 VC funding rounds in Q1-2022 with US$138 M in invested capital, a 2x increase compared to Q4-2021. Most of the investments went into e-commerce and FinTech companies. Bazaar, a Karachi-based B2B e-commerce platform that connects retailers with wholesalers and manufacturers, attracted the most funding with US$70 M in a Series B round led by US-based Dragoneer and Tiger Global Management.

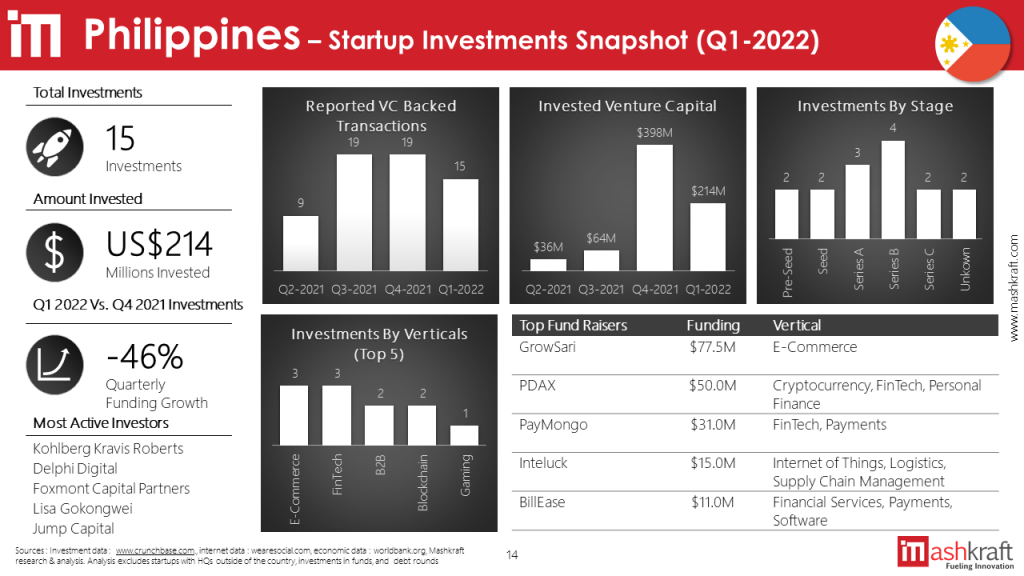

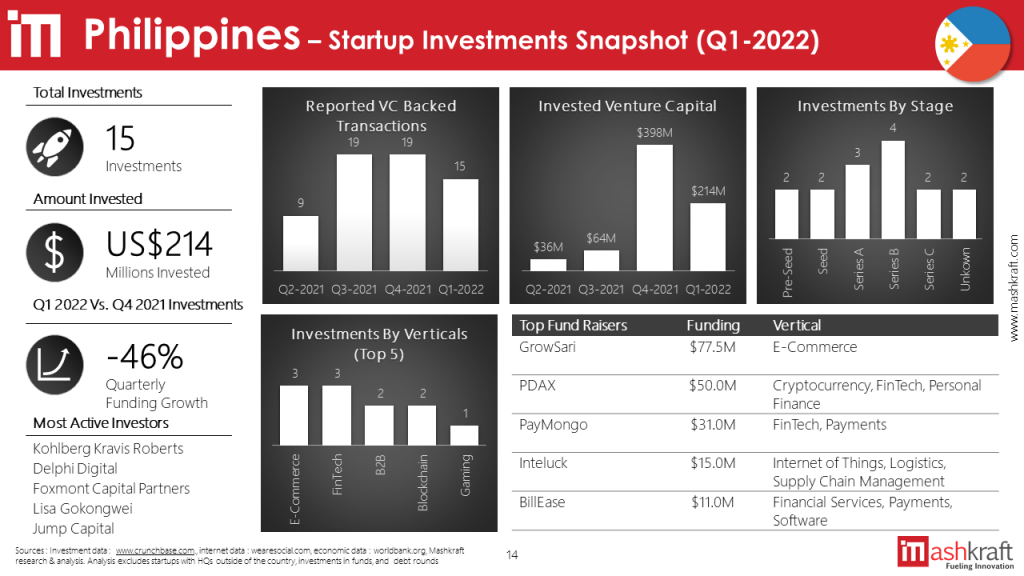

Philippines

Filipino startups saw at least 15 VC funding rounds in Q1-2022 with US$138 M in invested capital, a 46% decrease compared to Q4-2021. Most of the investments went into e-commerce and FinTech companies. Pasig Based GrowSari, which helps small grocery stores (called Sari-Sari stores in the Philippines) with digitization, attracted the most funding with US$78 M in two Series C rounds led by US-based KKR and the International Finance Corporation.

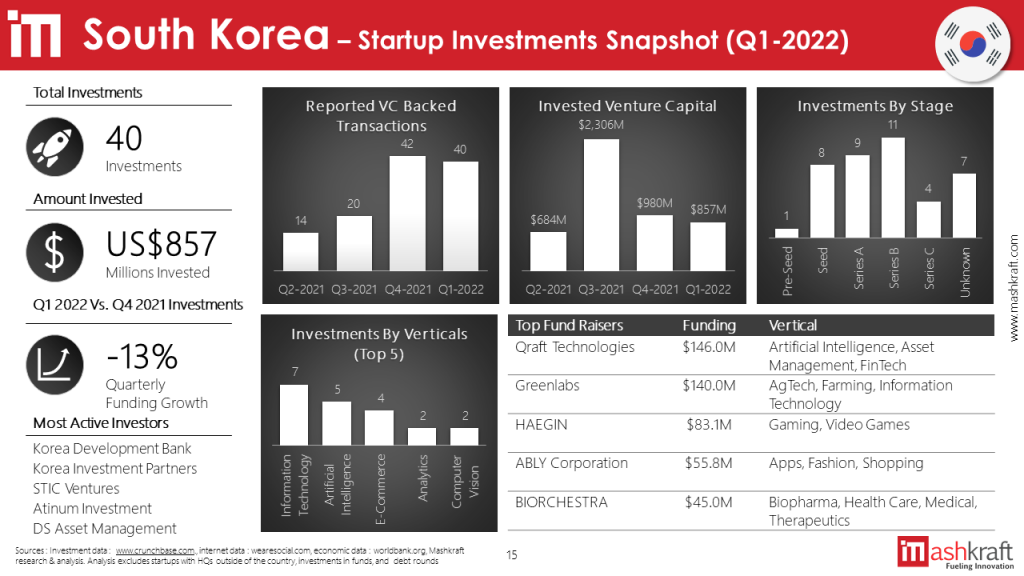

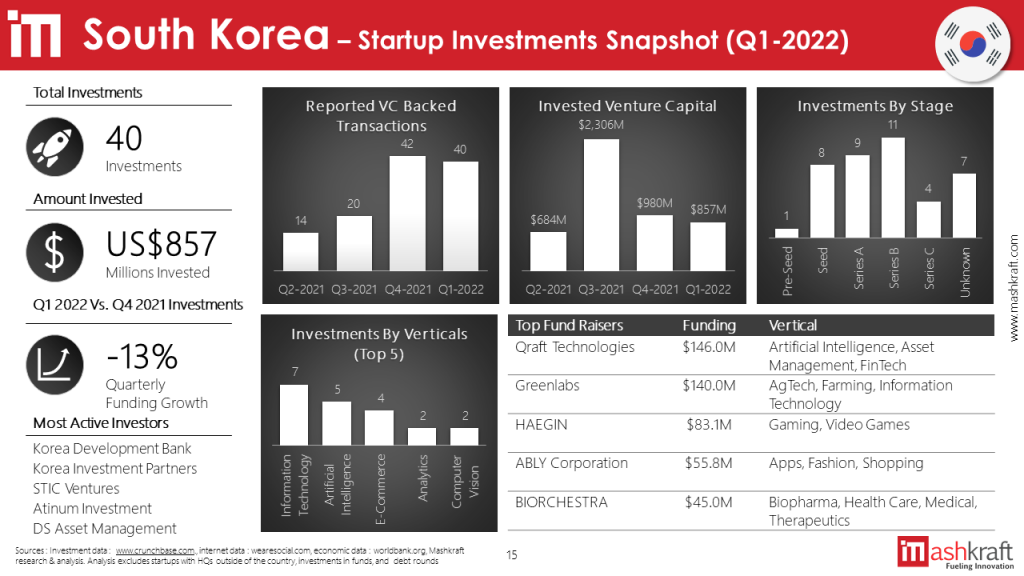

South Korea

South Korean startups saw at least 40 VC funding rounds in Q1-2022 with US$857M in invested capital, a 13% decrease compared to Q4-2021. Most of the investments went into AI-powered fintech, e-commerce and healthcare platforms. Qraft Technologies, a Seoul-based AI-powered investments platform attracted the most funding with US$146 M invested by Softbank.

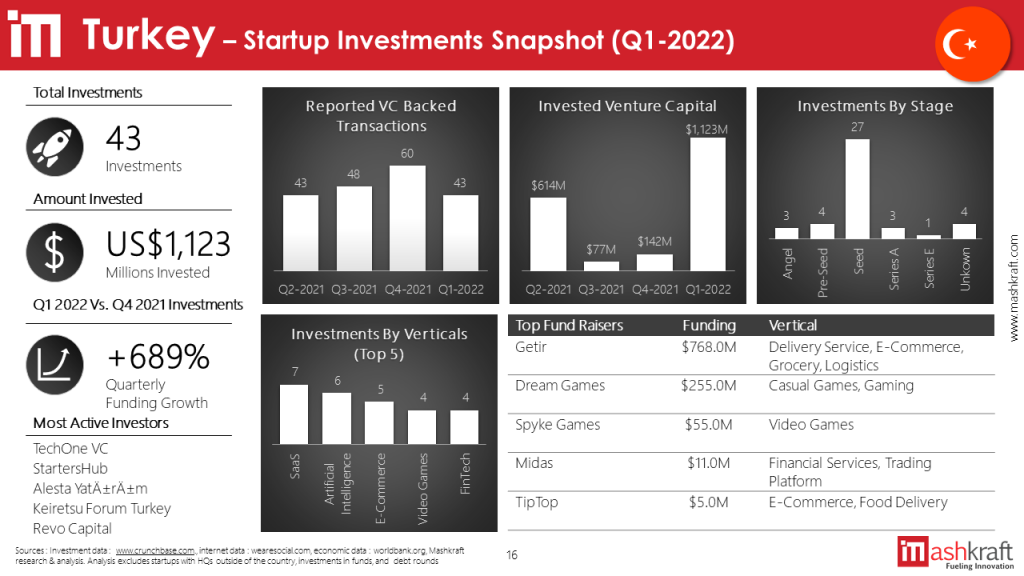

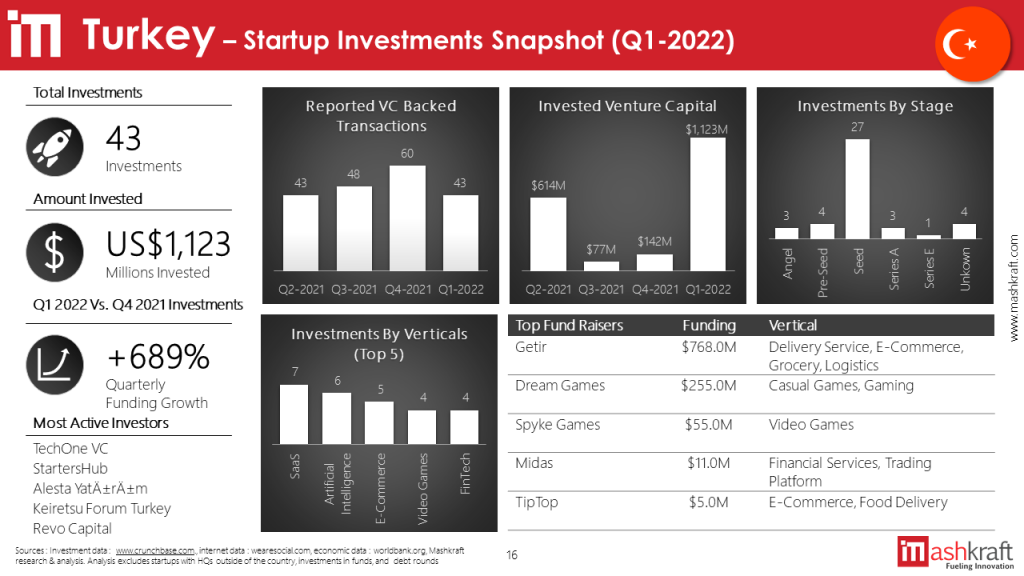

Turkey

Turkish startups saw at least 43 VC funding rounds in Q1-2022 with US$1.1B in invested capital, an 8x increase compared to Q4-2021. Most of the investments went into gaming and delivery companies. Getir, an Istanbul-based on-demand delivery services platform attracted the most funding with US$768 M in a Series E round led by Canada-based Khaira Capital, UAE-based Mubadala and US-based Tiger Global Management.

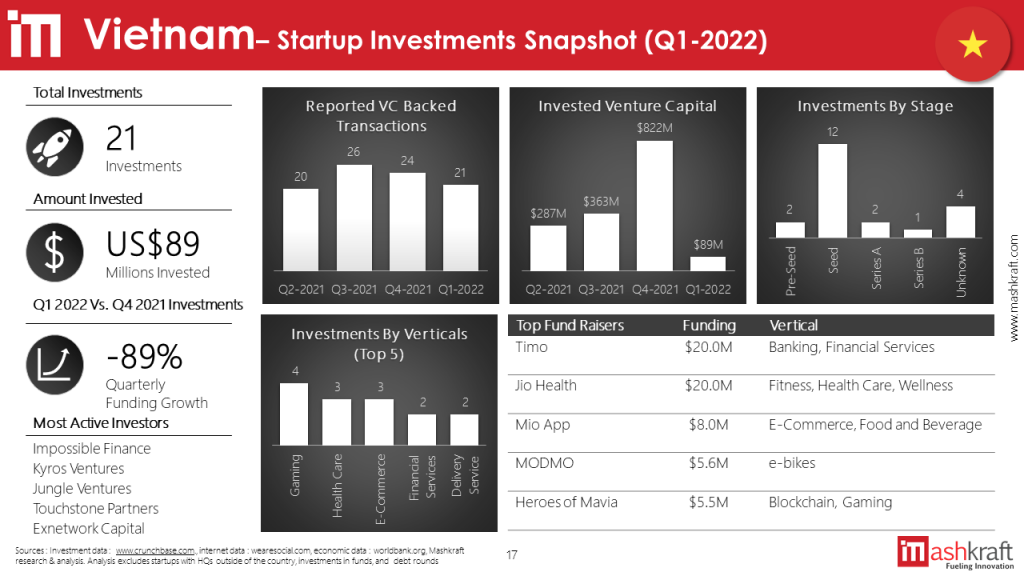

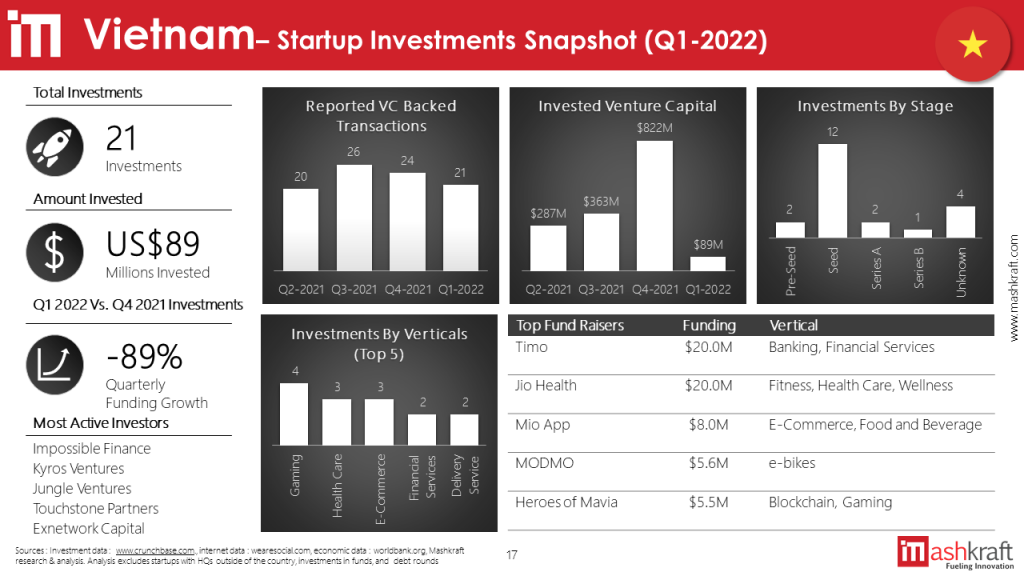

Vietnam

Vietnamese startups saw at least 21 VC funding rounds in Q1-2022 with US$89M in invested capital, an 89% decrease compared to Q4-2021. Most of the investments went into fintech and gaming companies. Ho Chi Minh City-based Timo, a digital bank, attracted the most funding with US$20M in a round led by Australia-based Square Peg Capital.